Binary Trading, A large part of successful Binary Trading comes from learning your mind and your studies. Let’s talk about the three most common cerebral miscalculations dealers make, and we also have some suggestions for you if you’re floundering with any of these.

2 Types of Quotex/ Binary Bot with 90% Accuracy is available in cheap, also accuracy proof available on live video call.

Cntact for more details on +923337363186 (Whatsapp)

FOMO Binary Trading

FOMO Trading Cerebral trading mistake number one, FOMO trading. The FOMO dealer is generally veritably auspicious about each and every trade, because this trade could be the one, right? commodity about this trade looks so much better than all the others, so it has to be the one. However, there may not be an occasion like this bone for a while, If I miss this trade. We can each agree how silly that sounds. Of course there is going to be further occasion around the corner, but although it sounds silly and egregious, the reality is that this type of allowing affects so numerous dealers, substantially because they do not indeed realise it’s affecting them.

And it’s a huge problem because it can beget you to do two effects.

Number one, it can beget you to take every trade you see, indeed if it’s not that good of a trade setup.

Number two, and this bone is indeed worse, it can beget you to increase your position size on a particular trade, because if this trade does end up being all that it’s cracked up to be, why would you only want to make a many hundred or a many thousand bucks on it? squint that, that is chump change.

Let’s swing for the hedge. And despite how important it seems like there is no way you can lose plutocrat on it, it turns into a losing trade. And now you have tons of your capital invested and are sitting on a huge loss that will be nearly insolvable to come back from. You can see how this can be a huge problem.

However, let me hit you with some wisdom from Charlie Munger who’s Warren Buffett’s business mate, If you’ve ever plodded with this. At a recent Berkshire Hathaway investor conference, Warren Buffett and Charlie Munger were talking about how they missed Google and Amazon because for some reason they had a eyeless spot and they did not see the occasion. In fact, Charlie Munger specifically said, we will keep missing them, but our secret is that we do not miss them all.

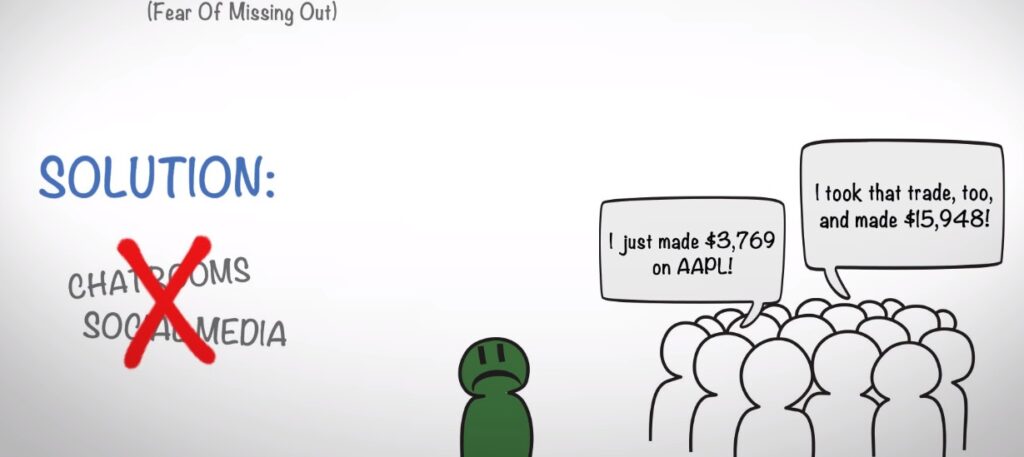

So just suppose about that for a second. However, also why should you be? You just have to understand that missing trades is a part of the game and it’ll be, If the stylish and richest investors in the world are not upset about catching every single investment. So if this fear of missing out is commodity you struggle with, then is our result for you. Trade Alone Stay out of converse apartments and trade alone for a week or so. And if you follow other dealers on social media, stay off of that as well. principally, isolate yourself and trade alone for a bit.

The reason I say this is because frequently in converse apartments or on social media, we see others making plutocrat and by nature, this instils a fear of missing out in the future. Now, keep in mind, we are not saying converse apartments and social media are bad by any means. We actually run a converse room ourselves that’s nothing short of inconceivable and we largely encourage you to check it out as it’s a great-great tool for your trading, but indeed we realise that some dealers might need to break down and trade alone for a couple weeks if they’re passing FOMO.

Now during this period where you’re trading alone, if you feel like you can not find trades or induce trade ideas without converse apartments or social media, also you likely need to stop what you are doing and come more educated on the strategy that you’re trading, so you know the process to find trades, when to enter and exit them,etc. Your trading strategy shouldn’t calculate on the trade ideas of other people. Trade ideas of others should be a tool, but not a bolstered.

Vengeance in Binary Trading.

Vengeance Trading Cerebral trading mistake number two, These are the types of dealers who can blow up their entire trading account and lose everything in just a day or a week. After taking a trading loss, vengeance dealers will throw everything they know about proper position sizing out the window and will trade like a madcap just to make back that loss. Now this may work formerly or doubly and you will come out unscathed, but if you keep this up you will get crushed, bad, and it’s going to hurt.

The request does not watch about you or your plutocrat and you are be the one 100 responsible for it if your vengeance trading causes you to lose everything in your trading account. So just be honest with yourself and if this is commodity you struggle with at each, just get a grip on it before it really ends up hurting you.

Then is our advice to anyone who struggles with this. First, if you are having this problem where losses are disturbing you enough to get you to this point of seeking vengeance on the request. So knock that position size down, trade lower size. This should allow you to not get so worried about losses and you will be suitable to start making opinions grounded off of sense rather than emotion.

With any trading strategy you are going to have losing trades every now and also, but the key is making sure your winners overweight your disasters. As Drake formerly said, you win some, you lose some, as long as the outgrowth is income. And if your position sizing is out of check and you are trading out of watchfulness or vengeance, also the outgrowth will surely not be income. Now if you are still having issues with this and you know that your position sizing is in check, also perhaps it’s your mindset or your prospects of trading that’s the problem.

You need to make sure you are committing and fastening on the long- term. Try to look at the bigger picture and suppose about how the long- term success is much more important than trying to make back that loss right now this veritably alternate. vengeance trading can also be a result of awaiting yourself to make plutocrat every single day. And anytime you’re negative on the day, you’ll do everything in your power to turn that around and be up plutocrat on the day. Well this is just not a realistic anticipation you should have. You should be concentrated on being positive on the time quarter, month, or at the veritably least week.

Gambler’s Falseness in Binary Trading

Gambling Cerebral trading mistake number 3, Gambler’s falseness. This might not inescapably be a cerebral mistake, but rather just a veritably common misreading of some introductory chances. And also it’ll beget you to make veritably poor trading opinions, and in some cases this bone can also compound and beget veritably big losses. This actually spans far once just the trading world, and as you can presumably guess by the name, it’s most generally associated with gamesters. We clearly do not want to treat our trading as gambling.

How to avoid this common mistake that so numerous dealers make. A quick google hunt will show you the description of Gambler’s Fallacy, but let me put this in nonprofessional’s terms that anyone can understand.

We all know that a coin flip is a 50-50 bet, so if you flip a coin 10 times, the anticipated outgrowth would be 5 heads and 5 tails. But although it’s anticipated that the same number of heads and tails will show up, we know that the factual number can diverge in either direction. Let’s say we plan on flipping a coin 10 times, and the first 5 coin flips all land on heads. What’s the 6th coin flip more likely to land on, heads or tails? If you said tails, also you my friend have fallen victim to Gambler’s falseness. Let me explain.

10 coin flips is, of course, 5 heads and 5 tails. We just covered that. But rolling 5 heads in a row doesn’t change the probability of the coming coin flip. The coming coin flip is fully independent from the once results. So what’s the 6th coin flip probably to land on after 5 heads in a row? The answer is that one isn’t more likely than the other, it’s still a 50-50 bet.

Bettor’s falseness refers to the thinking that a series of events will ever affect the outgrowth of the coming event, as if there were some kind of balancing force at work, the coin ever knew that it just landed on 5 heads in a row, so now it should land on tails.

And this Gambler’s Fallacy actually applies to numerous other corridor of life as well. exemplifications of Gamber’s falseness A many exemplifications are someone who flies a lot, allowing they’re ever working their way towards a crash, indeed though each cover is independent of the last. People at the summerhouse who see that the roulette wheel just landed on red 10 times in a row, so now they start putting their plutocrat on black, indeed though the former spins have no bearing on what the coming spin will be. And eventually, it also applies to trading, and so numerous dealers fall into the clutches of this fallacy.

However, this doesn’t mean that the coming trade will be a winning trade, just because you feel like the losing band has to end soon, If you have 5 losing trades in a row. Numerous dealers tend to increase their position size after a losing band because they feel their luck has to turn around soon. But the reality is, you’re just adding your threat on a trade. trade that has the same probability of success of all the bones you just lost plutocrat on. The request doesn’t know or watch if your last many trades were disasters or winners.

I found one good reading on “How to Overcome Fear and Greed in Binary Trading for Better Results“

Understand our today’s reading about “Binary Trading , 3 Common Psychological Mistake” and you will achieve better results in future

Conclusion

Now the result to this bone is easy, it’s just as simple as understanding it as you do now and also exercising mindfulness. Now that you understand what bettor ‘s falseness is, you should be apprehensive of it and just make sure you are not affected by this type of thinking. Try and treat each trade singly from any once trades you’ve made. If you have a band of disasters that doesn’t mean the coming trade will be a winner and on the wise side if you have a band of winners that does not mean the coming trade is more likely to be a clunker.

Trading is a figures game and you have to exclude these cerebral miscalculations and concentrate on trading the figures. Once you can do that you will take your trading to the coming position. The stock request isn’t a place for weak emotional people. Make sure your own worst adversary does not live between your cognisance.

Don’t miss out our top rated and 100% working Binary Trading Strategies post’s.