Hey traders, in this article Top 2 100% Quotex sureshots pattern pdf I will discuss about simple to learn trading strategies that’s able to generate $500 per day in profits. these strategies are all back -tested to have a high win percentage.

you can implement these steps and start trading immediately. So without further delay let’s move on and start this reading

Strategy # 01 Quotex sureshots pattern pdf

Stop Hunt

We use stop hunt in order to find trade opportunities. Now, for those who don’t know what a stop hunt is, here’s an example.

So, let’s say you look at a chart and you see the price rejecting an area multiple times, so you draw a support level. Next, as it approaches that level again, you think to yourself, the price did reverse from this support level in the past, so maybe it could reverse from it once again. Hoping for a reversal, you will enter a buy position.

However, instead of reversing from that level, price instead went down hitting your stop loss (in Forex Market) first before reversing back up. This is called a stop hunt, and it is purposely done by institutions to hunt the stop losses of retail traders. Now, using the right technique, we can actually use these stop hunts to our advantage to get high win-rate trade opportunities, and this is how. So, the first step is you want to find an obvious key level.

This could either be a support or a resistance level. But remember, the key word here is obvious, because you want to find a level where many retail traders (Forex) are also paying attention, which is usually more susceptible to a stop hunt. Here, we can see that the price went up to this level and reversed from it making it an obvious resistance level.

The next step is to wait for the price to approach that level again and break out of it. Once this happens, you take a closer look at the price action that’s happening at that area.

we can actually see a large green candle breaking that resistance area. Now, a question arises. How do we know if will be a stop hunt or an actual breakout and price did continue upwards? So, the good thing about this strategy is we could still make profits regardless of what’s going to happen.

When To Place Trade?

As soon as the price breaks this resistance area, immediately place a sell/ down side trade .

However, if this happens to be a real breakout and price/ market continue upwards, we don’t place trade because market don’t came down for retest and we won’t lose any money.

Strategy # 02 Quotex sureshots pattern pdf

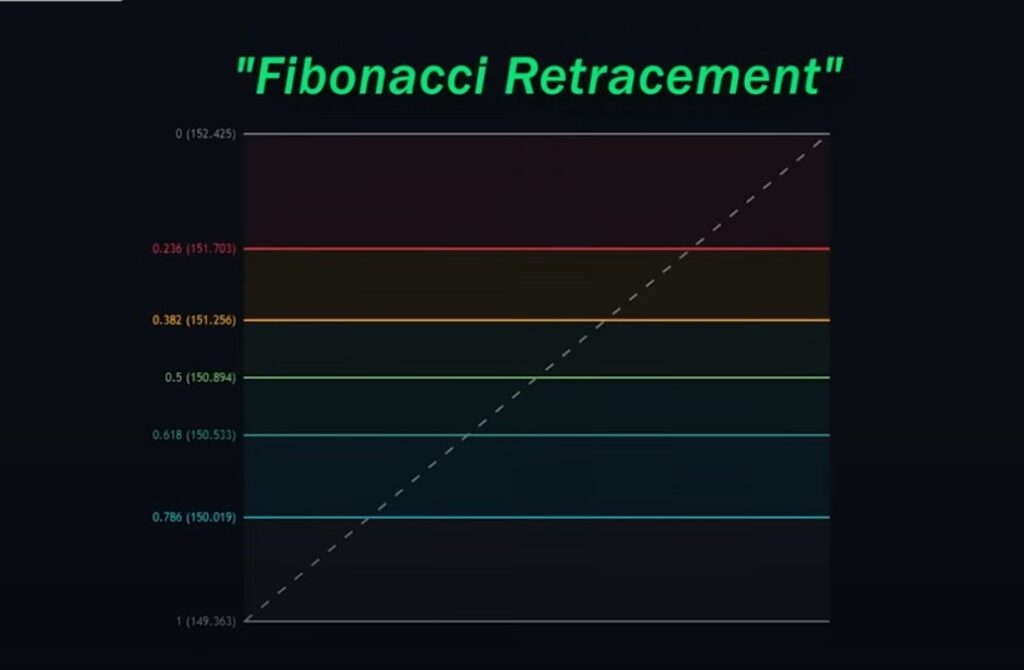

Fibonacci Retracement Quotex sureshots pattern pdf

So for this strategy, we’re utilizing the Fibonacci retracement tool, but we’ll be using it slightly different from what is usually taught.

What is Fibonacci ?

How the Fibonacci tool works, here’s a quick explanation. So, it is simply a tool that is used to identify where a pullback or a retracement might end. For example, if price moved upwards and forms a slight retracement, we can apply the Fibonacci retracement tool to know where this retracement might end. To do this, you drag the tool from the swing low to the swing high. Once applied, traders can observe these levels as they often act as possible levels where the retracement may end.

Method To Use

we’re only using the 0 .618 and the 1 .618 Fibonacci level. To do that, you go to the settings of the Fibonacci tool and disable all the other levels except the 0 .618 and the 1 .618. Once you’ve done that, your Fibonacci tool should look like this. Now here’s how you trade this strategy.

The first step is to look for a price action where there’s a trend and a slight retracement, like in this example. Next, you apply the Fibonacci retracement tool on that price action.

From here, we wait for the price to pull back towards the 0 .618 level and try to see if the price shows some type of rejection towards it. To do that, we do a multi -timeframe analysis by looking at lower timeframes to analyze the price action further. So we’re on the 4 hour timeframe, let’s zoom in into the 1 hour timeframe.

Now in the 1 hour timeframe, we can apply the MACD indicator for trend confirmation. As you can see, the MACD indicator crossed over upwards after price hits the 0 .618 level, which further confirms that the price will likely bounce upwards from that level.

And so we go back to the 4 hour timeframe and enter a buy position. The next step is we use the tool once again, take the last highs of the retracement and Once again, take the last highs of the retracement. it towards the lows of the retracement. And this is where the 1 .618 level comes into play.

Where to place the trade for 1 Minute?

Refer to 0.618 level when market touch and take reversal, the next candle will be the trade candle. Place trade for 1minute, in case of trade loss use 1-Step MTG and always use money management for good profit and to avoid loss.

Quotex sureshots pattern pdf

Remember Always back Test your new strategy for at least 1 week, then trade on live account.

Always Test these strategy and follow rules. For more strategies please visit https://binarytradetricks.com/category/strategies-sure-shots/, also you can search Fibonacci Tool Videos here. so We end this article Quotex sureshots pattern pdf here. Thanks