In this Article Quotex Bug Sureshot I will share most profitable 2 strategies and its easy to use and understand. Both strategies work on Quotex Binary and Forex brokers

Strategy # 01 CCI Divergence

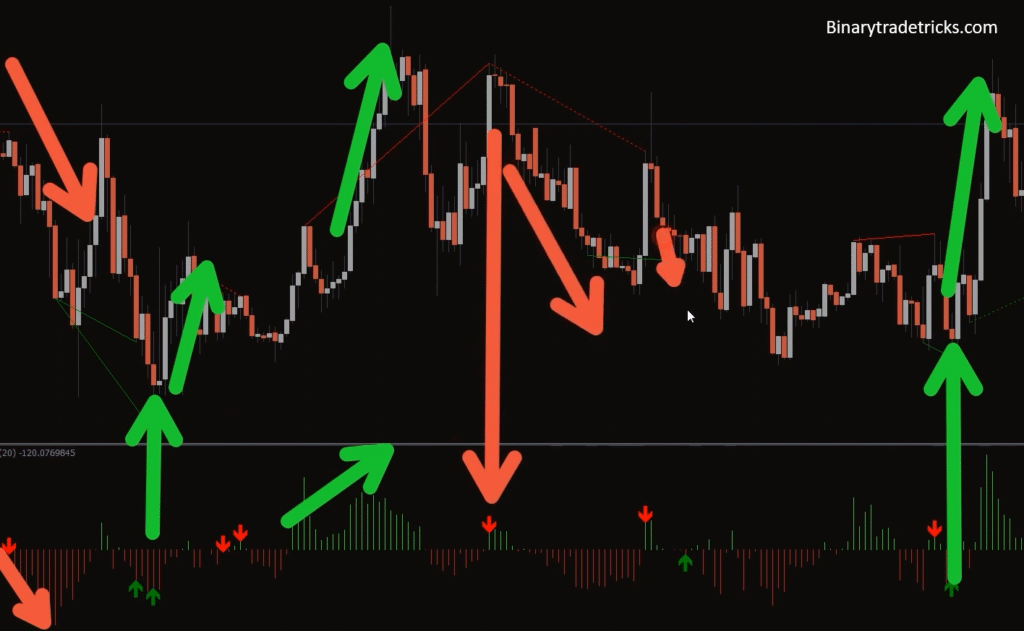

So unlike the other strategies on this list, this one is a scalping strategy and we’ll trade it on the 1 minute timeframe using an indicator called the CCI in Quotex. And so based on back testing results, the CCI is particularly effective for identifying divergences.

What is Divergence or CCI Divergence?

For those of you who don’t know how to spot divergences, here’s a quick example. So usually, an indicator will display the same signal as the price movement. If the price forms higher highs, the indicator will also display higher highs. However, there are setups where it’s the opposite.

For example, price forms higher lows but the indicator displays lower lows instead. And this is called a divergence. Specifically, this is a bullish hidden divergence, presenting a good opportunity to take a buy position. There are multiple types of divergences.

This strategy works by doing a live trading session So first, you want to apply the CCI indicator onto your charts. And if you’re using the simple effects platform like I am, you can go the indicator section and select CCI. After that, go to the one -minute chart and find a setup where the price forms a divergence. You can use the search menu here to find different charts, whether it be Binary, Quotex, crypto, forex, stocks, or others. So after some searching, I came across this setup on one –minute timeframe chart in Quotex.

Price formed lower lows but the CCI displays higher lows. And based on the guide, this is a bullish divergence.

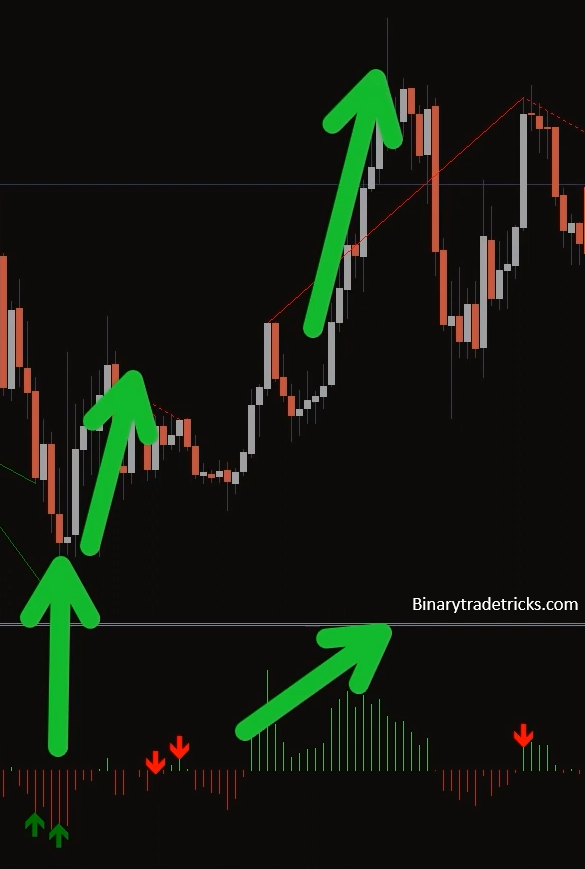

Forex Trade

And for Forex brokers To do that, click the buy button here and set your position size for this trade. Next, for a take profit target, we can set it at this minor resistance level at 64379. So you insert that. Now for a stop loss, we can set it at slightly below the support area at 64209. And insert that as well. Here, you can see how you’d make if price hits our profit target and how much we’d lose if the price hits our stop loss. Next, click submit to open the trade and let the trade run. And as you can see, price hits our take profit.

Trade Results

You can keep repeating this strategy over and over again as long as you spot a divergence.

Strategy # 02 Range Market

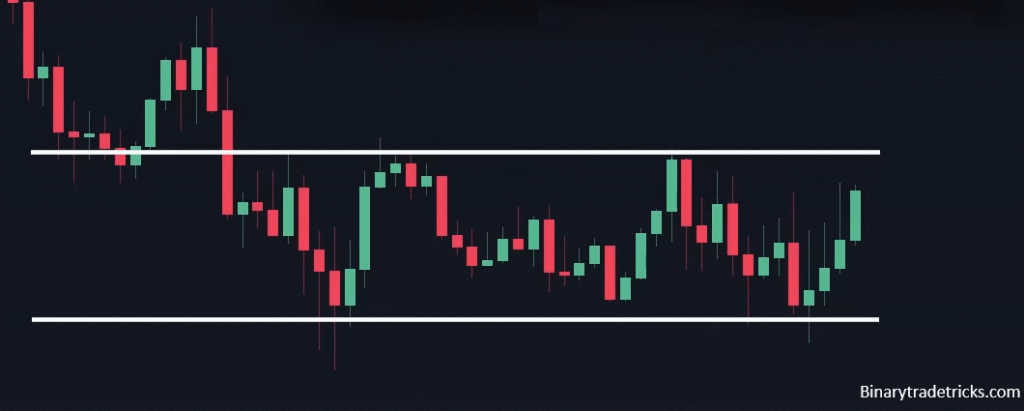

So this one is one of my most profitable strategy that has allowed me to scale my trading account considerably. And this is how. So, we know that markets are only trending about 30 % of the time, while remains within a range about 70 % of the time.

Trend vs Ranging Market

This means that prices aren’t always moving towards a certain trend. Most of the time, they move overall sideways while deviate between certain levels. Because of this, if you know a strategy to trade range markets, you’ll be able generate more profitable signals. And here’s how this strategy works. The first step is to identify a range market, which is simply a market that moves overall sideways. Now, during a range market, you should be able to identify both support and resistance level within that range. For example, if price rejects an upper level multiple times, that’s your resistance.

And if it rejects a lower level, that’s your support. Now, here’s how I trade range markets differently from most traders. Instead of only trading at these major key levels, I also take advantage of the price action that’s happening in this middle area. And to do that, I draw another line in the exact middle of these major key levels. This is what I call the midline. So, using the midline that we drew, we can now see that the range is divided between two zones. The upper zone and the bottom zone.

So, we know that as long as price stays within this range, only two things can happen. Either it stays on this upper zone, or switch to this bottom zone. And it will keep doing this until eventually, price breaks out of the range. But for this strategy, we only trade if the price still remains within this range. So, here’s how it works. The first step is to identify where the current price is positioned. In this example, it is currently in the upper zone after it rejected this resistance level.

Next, you wait for the price to approach the middle line. Now remember what I said

earlier. As long as the price is still inside this range, it’s either going to stay on this upper zone and bounce upwards from this middle line, or switch to this bottom zone and breaks this middle line downwards.

Market Approach

In order to know that, we need to analyze the price action as it approaches this Level. So, a rule of thumb to remember, is that price will likely move towards the bottom level if it manages to break the Level decisively. For example, if there’s one giant momentum candle crossing down, or if there’s multiple red candles.

Rejection from Level

Here, we can see that the price briefly moved downwards all the way here, but buyers pushed it back up before the candle manages to close, which formed this long wick below this candle. So now, after multiple attempts of breaking below the Level, price failed to do so. Meaning there’s a chance that the price will actually remain above the upper level and retest this resistance level.

Market Break Level

However, if we manage to see some type of rejection in this Level, there’s a high chance that the price will likely remain above the Level and retest the resistance level. So, let’s see what happens to the price next. As you can see, it briefly broke through the Level but managed to bounce back up, indicating that there’s a slight rejection in this middle area. However, because this is only a slight rejection, we still need more confirmation. So, let’s not rush to take a position and observe what happens next.

Place trade for Call Direction Quotex

So this is a good opportunity to enter a buy position in Quotex binary broker

Forex Trade

For forex traders, your profit target, set it at the resistance level and stop loss at slightly below your entry.

Trade Results

And as you can see, price went upwards towards the resistance level and hits our tick profit.

That’s all Quotex Bug Sureshot for today, and thanks for follow me and my trading methods for Quotex and forex market. Remember to back test these strategy in Quotex by yourself if you find good in this then follow on real account.

For more Quotex Sureshots strategy please visit our Category section.